Many catastrophic events such as large hailstorms, hurricanes, wildfires and tornadoes occur with limited warning and result in sudden, significant losses for property owners. That’s why American Family Insurance is partnering with UW–Madison experts to create wind-related weather models that more accurately predict these events, helping the company prepare for insurance claims and protect its customers.

When such events occur, American Family must quickly mobilize resources and claims adjusters to service an increased number of customer claims as fast as possible. Accurate, timely prediction of the volume and location of expected claims can greatly help with resource planning and lead to better outcomes for customers.

Although advancements in radar detection technologies have improved the estimates of hail-related storm impact, this is not the case for wind-related damage.

To improve wind damage estimates, American Family is partnering with Michael C. Morgan, a professor in the Department of Atmospheric and Oceanic Sciences at the University of Wisconsin–Madison, and Brett Hoover, a researcher at the UW Space Science and Engineering Center. The company is exploring the use of updated numeric weather prediction output in conjunction with traditional measurement techniques – a first in the insurance industry – to generate a framework that will provide improved understanding of the surface wind field in near real time, and more importantly, to be used as the foundation for a machine-learning methodology for forecasting insurance claims.

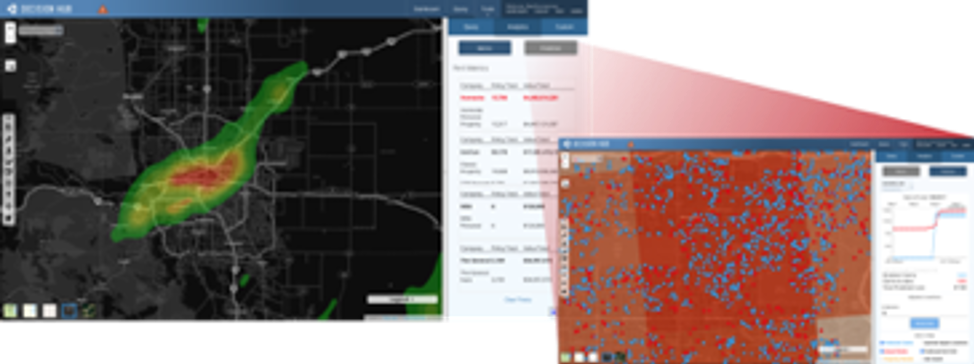

Real-time situational awareness is a critical need for American Family’s Catastrophic (CAT) Claims team in order to properly optimize resources and satisfy policyholders. The CAT Claims team uses a powerful data and mapping application called Decision Hub to visualize and quantify the impact of a severe-weather event. Decision Hub draws on multiple weather-data feeds, including radar-derived hail size estimations, damaging wind speed swaths and crowd-sourced storm reports. The data are fused with the company’s policy and claims data to provide a comprehensive view of potential impact immediately following a storm. Adding weather forecast data to Decision Hub will provide a 48-hour view into the future and help the team be more proactive.

The updated forecast models will provide a 48-hour forecast four times a day. Each forecast model uses updated weather observations from NOAA and predicts multiple weather variables, including precipitation, wind, temperature and pressure. The predictions flow into Decision Hub, which uses several spatial algorithms to simulate potential severe-weather impact to American Family’s portfolio.

This weather forecast model also provides an opportunity to train machine-learning algorithms to accurately predict severe weather outcomes. The process uses historical weather forecasts for catastrophic events for which American Family has historic claims data and other business outcomes. By fusing historic business data with historic forecast models, the company will be able to more accurately predict how severe weather will impact its policyholders and finances.

As Jim Rohn, an American entrepreneur, author and motivational speaker, said: “It’s not the blowing of the wind that determines [your] destination, it’s the set of the sail.” In this case, when the wind blows, American Family is setting its sails using state-of-the-art weather modeling technology to reach its final destination: protecting and restoring its customers’ dreams when Mother Nature hits hard.

American Family Insurance supports Morgridge Center Wisconsin Idea fellowships

Madison-based American Family Insurance supports two Morgridge Center for Public Service Wisconsin Idea fellowships each year, as part of its partnership with UW-Madison.

In 2018, one of those fellowships was awarded to Chloe Green, then a junior majoring in dietetics and in community and environmental sociology.

In 2018, one of those fellowships was awarded to Chloe Green, then a junior majoring in dietetics and in community and environmental sociology.

Chloe was studying the barriers those who are food insecure encountered in accessing local farmers markets as a source for healthy, nutritious food. She spent the summer of 2018 traveling to farmer’s markets throughout southern Wisconsin, interviewing attendees, vendors, and organizers.

Chloe asked about how aware people were of when and where farmers markets were held, as well as their proximity to public transportation, acceptance of payment via federal program vouchers, and more. Based on this field research, Chloe determined that general awareness and acceptance of payment by those on the federal Supplemental Nutrition Assistance Program (SNAP) were two significant barriers for this population to access farmers markets.

Typically, the Wisconsin Idea Fellowships is a single year in duration. In the fall of 2019, Chloe approached American Family with the request that the company help support the second phase of her work, and that was to take her initial learnings and apply them to a single farmers market. If specific work around awareness and payment acceptance could garner more access by those food insecure, perhaps these efforts could be adopted by farmers markets across the state. American Family was impressed by Chloe’s drive and vision for the project: “Chloe came to us with a clear idea and strong conviction that her work held promise, both for those suffering from food insecurity, and for farmers markets in general. We were interested to see where this could go.” said Judd Schemmel, AVP of Community Investment and Partnerships with American Family Insurance.

The Brown Deer Farmers Market was selected as the model site to implement Chloe’s modifications. Leading up to the summer of 2019, Chloe worked with the market, as well as the surrounding neighborhoods and local organizations to ensure strong awareness of the market. The communication efforts included a clear message that those taking part in the SNAP program were welcomed. The next step was to ensure that merchants at the market had access to the appropriate technology to accept SNAP payments.

So how did the target pilot perform? While a final report on the Brown Deer farmers market is pending, as of September, the market had seen utilization by SNAP program participants doubled from previous years. The early success of the pilot means a strong farmers market for the community, and more individuals who suffer from food insecurity have another option for accessing healthy, nutritious food.

American Family sees the added support for Chloe’s work as a great investment, “We’re really proud of what Chloe’s work can mean not only for the Brown Deer farmers market, but for markets across the state, and how these venues can more directly serve individuals and families in need.” Schemmel added.

While Chloe has graduated, her work lives on. American Family will be engaging with Chloe’s faculty advisor to determine how these best practices can be shared with other farmers markets. The work that Chloe Green pursued, and was able to bring forward, is truly the Wisconsin Idea at its best.

American Family Insurance supports UW Athletics with the Badger Fam Club

American Family Insurance supports UW-Madison and its students, alumni and fans. Headquartered in Madison, American Family’s founder, Herman Wittwer, was a Badger himself, so supporting the UW is part of the company’s history. Now, American Family has announced its new UW initiative, the Badger Fam Club.

American Family Insurance knows being a fan is about more than just sporting the team’s signature red and white. It’s about being part of a family. That’s why American Family is bringing fans together — because when we cheer together, we win together.

American Family Insurance Badger Fam Club

Badger fans across the country are invited to join the American Family Insurance Badger Fam Club. Fam Club members will enjoy exclusive Badger fan-centric content and be eligible for unique prizes and experiences. Plus, you’ll get the chance to win the ultimate football, basketball or hockey championship experience. Enter now at AmFam.com/Badgers.

Prize Package

Join today for a chance to win one of the following exclusive experiences:

College Football Championship Experience

- Round-trip airfare and tickets for two to the championship men’s game in New Orleans on January 13

- Hotel stay for three nights

- $500 prepaid credit card

- And more

College Basketball Championship Experience

- Round-trip airfare and tickets for two to the men’s finals games, including the championship game in Atlanta on April 4 and 6

- Hotel stay for four nights

- $500 prepaid credit card

- And more

College Hockey Championship Experience

- Round-trip airfare and tickets for two to the men’s finals games, including the championship game in Detroit on April 9 and 11

- Hotel stay for four nights

- $500 prepaid credit card

- And more

American Family supports UW–Madison’s UniverCity outreach

As UW–Madison’s UniverCity Year program moves into its fourth year, it’s found a corporate sponsor in American Family Insurance that supports the way the program helps students learn while solving real-world problems for Wisconsin communities.

Launched in 2016, the program brings faculty, students, and community members together to improve the sustainability, resilience, and general well-being of Wisconsin’s communities.

“American Family is proud to support efforts like this that spur innovations to address challenging issues in communities large and small,” said, American Family Insurance Associate Vice President of Community Investment and Partnerships, Judd Schemmel. “With the previous three partners, we’ve seen great proposals brought back to the municipalities; jumpstarting affordable housing plans, advancing innovative low-carbon emission transportation solutions, design and financing plans for alternative energy systems, and more.”

This year’s partner is Green County; previous partners were the City of Monona and Dane County.

As part of UW–Madison’s UniverCity Year partnership with Green County, a team from the Department of Civil and Environmental Engineering’s senior capstone design course proposed a renewable energy system to help offset Juda School’s energy expenses by 25 percent.

UW–Madison seniors Morgan Keck, Connor Acker, Emma Connell, Brooke Marten and Robin Ritchey analyzed possible renewable energy systems for Juda School from five perspectives: environmental impact, safety, constructability, cost and social considerations.

Their research and analysis has pointed to a system that incorporates both a geothermal heating and cooling system and a rooftop solar panel array to bolster Juda School’s existing solar setup. The students are also exploring funding options that would help the school district pay for such a major upgrade.

“It’s given me confidence that I could go work on something that I’ve never really experienced before, and be able to learn it quickly,” says Ritchey.

Support from American Family has helped UniverCity Year expand across the state. Pepin County will be the program’s partner next academic year, and UW–Madison and community officials are already looking at potential projects. UniverCity Year projects are matched with interested UW–Madison faculty members, who then incorporate the selected project into their coursework. UniverCity Year facilitates interactions with the community and provides funding opportunities to supplement or enhance course work as it relates to the project.

Potential projects in Pepin County involve economic development, environmental and water issues, and solid waste and recycling programs.

“We are hoping that the environmental engineering students at UW–Madison can help us to determine base flood elevations for floodplains so that we can help people understand the risks associated with building in certain areas of the county,” said Maria Nelson, the Emergency Management Director, Zoning Administrator, & Land Information Office in the Pepin County Land Conservation and Planning Department.

Gavin Luter, director of the UniverCity Alliance and the UniverCity Year program, wants to see students and faculty work alongside Pepin County residents.

“We’re thrilled to be working with Pepin,” said Luter. “This is the first community we’re working with that’s in the northwestern part of the state, so it’s a great opportunity to take UCY on the road and show that we are a true embodiment of the Wisconsin Idea.”

After Pepin? American Family is helping the program think through its business model and diversify its funding sources so it can continue to work across the state.

UniverCity Year is a program of the UniverCity Alliance, a cross-campus effort to make UW–Madison better positioned to help cities solve their most pressing challenges.

Help Choose the Next

Game Day Dreamers

Badgers across the world are making a difference every day, year after year – and American Family Insurance wants to celebrate that! The Game Day Dreamer program highlights and awards inspiring Badger students, alumni and fans across the nation in a special half-time presentation during the Badgers Men’s Basketball game on Mar. 2, 2019!

“We’ve witnessed first-hand the amazing impact Badgers have had, and continue to have both in our community and across the country,” says Dan Kelly, American Family Insurance CFO and UW graduate. “That’s why we created Game Day Dreamer Program — to honor that.”

Six finalists have been chosen, now it’s up to you to help us choose the 3 honorees. Read more of their stories and cast your vote.

Prize Package

Each Game Day Dreamer will receive:

- Recognition highlighting the winner’s efforts and contributions to the community

- Two tickets to the men’s basketball game against Penn State on March 2. Winner will be escorted on-court by Bucky Badger and honored during the half-time show

- Meet and greet with an American Family Brand Ambassador or Bucky

- $3,500 contribution in the winner’s name to the charity or cause of their choice

- Roundtrip airfare for winner and guest to Madison

- Three-night hotel accommodations.

- $500 prepaid credit card.

American Family Insurance has pledged $40 million to support UW-Madison academic programs, research, athletics and charitable activities over 10 years.

American Family Aims to Highlight Inspiring Badgers

American Family Insurance has supported UW-Madison and its students over the last several years — in the classroom, on the field, and throughout campus. Now, American Family has announced its new UW initiative, the Game Day Dreamer Program, which highlights and awards Badger students, alumni and fans alike for their community-focused work in a special half-time presentation.

“We’ve witnessed first-hand the amazing impact Badgers have had, and continue to have both in our community and across the country,” says Dan Kelly, American Family Insurance CFO and UW graduate. “That’s why we created Game Day Dreamer Program — to honor that.”

The program has also received the support of inspiring UW alumni, whose own paths exemplify the mission of the program. Roberto Rivera, UW-Madison graduate and Chief Empowerment Officer of 7 Mindsets, has spent his career working with young adults who struggle with school and life challenges.

“Being a Badger means being able to dream and courageously push past your fear to make that dream a reality,” said Rivera.

Like Rivera, Mark Tauscher has also devoted himself to educational causes. As a former Badger, Green Bay Packer football player and member of the Packer Hall of Fame, Tauscher has also established the TRIFECTA Foundation, a non-profit that promotes literacy in children.

“To be a part of [the Badger] community, to be part of what it means to be a Badger, (means) just a ton of pride,” said Tauscher.

GAME DAY DREAMER PROGRAM

Badger fans who’ve got their own inspiring stories to tell now have a platform to do so, by entering the contest online at amfam.com/gamedaydreamer. Finalists will be chosen to move onto the next round on February 5 — a public vote that will choose the winners.

Three honorees will be selected for a Game Day Dreamer prize package, which includes an all-expenses paid trip to Madison and the opportunity to be honored at the March 2 men’s basketball game in a special half-time show celebration. Each honoree will also receive a $3,500 contribution in their name to the charity of their choice.

To enter, nominations must include a short description of your achievements or efforts, a photo or video of yourself, and, if possible, additional information (websites, articles, etc.) about your achievements or efforts.

PRIZE PACKAGE

Each Game Day Dreamer will receive:

- Recognition highlighting the winner’s efforts and contributions to the community

- Two tickets to the men’s basketball game against Penn State on March 2. Winner will be escorted on-court by Bucky Badger and honored during the half-time show

- Meet and greet with an American Family Brand Ambassador or Bucky

- $3,500 contribution in the winner’s name to the charity or cause of their choice

- Roundtrip airfare for winner and guest to Madison

- Three-night hotel accommodations

- $500 prepaid credit card

American Family Insurance has pledged $40 million to support UW-Madison academic programs, research, athletics and charitable activities over 10 years.

American Family Insurance Leverages

their Internship Program for Talent

American Family Insurance provides internship opportunities to UW–Madison students in hopes of giving them valuable workplace experience as well as a taste of what it’s like to work for a great company. The internship program is an opportunity for ambitious students to engage in professional and challenging work and join our talent pipeline for future full-time openings.

We are seeking talented, customer-focused innovators to fill paid student internship positions. Our interns make a difference every day by delivering exceptional service and protecting our customers.

Read how James Ziglinski, who majored in math and computer sciences, turned his experience as an Information Services intern in 2015 and 2016 into a full-time job.

What did you get to work on as an intern and do you believe it brought value to the organization?

I worked on two teams as an intern. While on the native Android team, I did proof of concepts (POCs) for various Android apps the company was thinking about building. We presented these to the whole company at the end of the summer and a couple of the POCs were continued and used. When I was part of the mobile-web team, we were tasked with rebuilding an internal website. It was actually really fun and we were given a ton of freedom. Again, at the end of the summer, we presented our website to the entire company and to this day, people still tell me how they like the new website much better than the old one.

What experiences did you have during your internship, outside of the work?

I was given opportunities to learn about various areas in the company and even took an all-day class about the overall insurance industry. We also got to do some career building courses, took a trip to DreamBank, and were given tours of different areas within National Headquarters; all during the workday, while getting paid. Outside of work, we went on a Betty Lou cruise and went to a Brewers game in the AmFam box at Miller Park. There were also tons of intern meet ups. I was lucky enough to develop close friendships with some of the other interns and we still get lunch together a few times per week.

What was the best part of the internship?

The freedom. I was given room to breathe and do my work. Nobody is micro-managing you, but the support is there if you need it. The company is really focused on you developing as a professional, while completing work for them. As a programmer, it is essential to spend time keeping up with changes in technology, so the freedom really allowed for me to grow in areas that interested me.

Describe the company culture.

Very laid back. Everybody has things going on in their lives, so work-life balance is important. The company embraces this and actively strides to make work not get in the way of life.

Were you hired as a full-time employee after your internship?

I was able to continue my internship into the fall school semester and was given a full-time job offer on one of the last days of the summer to begin as a full-time employee in January 2017.

What do you find exciting about being part of American Family Insurance as a full-time employee now?

Aside from the pay and benefits, the potential. I am working on an awesome project, using modern technologies, with great people. One of my biggest fears as a programmer was getting put on team where I would be given backlog tasks for a year, which didn’t happen. It is really nice to know I am creating future opportunities for myself, while also getting my work done.

Looking to the future, American Family Insurance will continue to use the internship program as a pipeline for future talent because it’s been so successful for the company.

If you’re seeking a rewarding internship experience, where you’ll grow personally and professionally, as well as have an impact on business outcomes, please consider American Family Insurance. Visit amfam.com for more information about internship opportunities in Claims, Business, Marketing, Information Technology, Actuarial, Legal and other areas. You can also watch our internship video to see what it’s like interning at American Family Insurance. AmFam will work with you to discover your passion that puts you on the path to success.

American Family Insurance and

UW–Madison Share Deep Roots

It all started with a hard-working Badger named Herman Wittwer. After graduating from UW in 1929, Wittwer was inspired to help local farmers find affordable, reliable insurance. With some innovative thinking and a customer-driven approach, Farmer’s Mutual was born. Today, you know Farmer’s Mutual as American Family Insurance.

American Family Insurance, a major corporate partner, continues to make a difference at the University of Wisconsin-Madison as the new academic year starts. Their pledge of $40 million over 10 years supports UW academics, research, athletics, and charitable activities.

Stay tuned for stories in Inside UW throughout the year where we’ll highlight how American Family and UW–Madison combine efforts to benefit our university, our community and our world.

As an added benefit, the alliance also provides UW students, faculty, and staff with discounts on the auto, home, life and business insurance products they need to help them protect what they’ve worked so hard to achieve. Learn more about the strength of the UW–American Family partnership by visiting amfam.com/onwisconsin.

American Family reaches out to help prepare

UW–Madison students for careers

American Family Insurance has taken an increasingly active role in helping UW–Madison students prepare for careers, through everything from business competitions to mentoring students to educational conferences.

The Madison-based company hires many students as interns and, ultimately, full-time employees.

“Our employees find it rewarding to work with UW–Madison students and to provide them with real-world experience and advice to prepare them for the future,” said Kari Lauritsen, Director of Talent Management for American Family. “We are pleased to be able to tap into the talent at UW–Madison by hiring many of these students after they graduate.”

American Family employees partner with several different programs across the university.

Employees from American Family’s Business Development division volunteer as judges at the Wisconsin School of Business’s annual Business Plan Competition. They advise the student entrepreneurs on how to improve on their business plans and mentor them as they try to turn their ideas into reality.

Started in 1998, the event has seen steady growth in the caliber of projects and innovative ideas. The 2017 contest featured 63 students across 24 teams representing 26 majors. This year’s competition is April 26 and 27.

Past winners have gone on to create many successful businesses, including Pathogenomica, which uses high-speed genetic sequencing to detect pathogens in water; Chefs for Seniors, which cooks meals in-home for seniors; and EatStreet, a food delivery company.

American Family also helps with career development and preparation efforts in the College of Letters & Science. Efforts include the newly opened SuccessWorks career center; Career Kickstart, a career preparation residential community in Ogg Residence Hall; and internship and career fairs.

In their interactions with students, American Family employees provide insight on the variety of jobs available at the company.

“Many students are eager to hear about what opportunities await them after college, and what skills they need to develop,” Lauritsen said.

One student who benefited was Grace Corry, who graduated in May 2017 with degrees in political science, international studies and French. She got an internship in American Family’s Community Investment Department. She was one of roughly 70 interns at American Family that summer. The internship gave her firsthand insights into the working world, as well as confidence when she took her first job at a business management software company in Chicago.

“It’s training you to go out into the real world,” Corry says. “Seeing actual results of your work in a company or in the community, that’s really cool.”

American Family also is a sponsor of the Chancellor’s Scholarship Program, which helps academically talented and outstanding young people from under-represented groups develop their intellectual gifts, abilities, skills and potential. The sponsorship includes tuition, paid internship opportunities that allow the student to rotate through various work functions at American Family and guidance from American Family executive leaders.

In addition, American Family participates in the Co-curricular Learning Board in Actuarial Science & Risk Management, a joint industry/faculty/student group within the School of Business that develops and promotes actuarial science and the risk management profession, hosting events for students.

The board is planning an Innovation Summit from 5 to 7:45 p.m. on March 6. Each participating company will spend 15 minutes highlighting its innovation, and volunteers will facilitate small-group discussions after each presentation. An American Family team will speak to the group about the evolving world of telematics, a branch of information technology dealing with long-distance transmission of computerized information.

American Family also provides funding for the Black Graduate Professional Student Association’s efforts and the Division of Diversity, Equity & Educational Achievement.

American Family stays connected and engaged with students and alumni through its Talent Community – which you can connect with through its Careers page.

In addition, to attracting great talent, the partnership provides engaging opportunities for current American Family employees through experiences, professional development and opportunities to partner with world-class researchers.

“Our career-preparation partnerships with UW–Madison have been rewarding for us, and for the students, on many different levels, and they don’t have to end with graduation,” Lauritsen said.